Nvidia (NVDA) stock continues to break records, reaching new all-time highs fueled by surging demand for its industry-leading artificial intelligence (AI) chips. But for investors, the question remains: is Nvidia a buy now?

Nvidia Stock on a Tear: Poised to Topple Tech Titans?

In an unprecedented surge, Nvidia ($NVDA) has shattered records, reaching a staggering $1,237 per share after hours trading. This astronomical rise translates to a 155% gain in 2024 alone, adding a mind-boggling $1.83 trillion to its market cap.

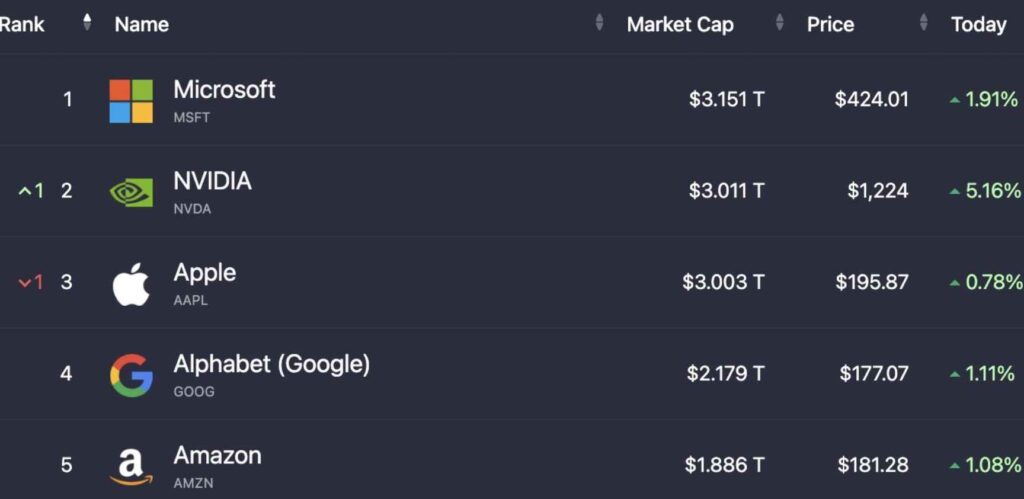

For perspective, Nvidia’s market cap growth in just six months matches the entire current value of Amazon ($AMZN). This meteoric rise has propelled Nvidia to the coveted position of the world’s second-largest public company. Even more impressive, it’s responsible for nearly half of the S&P 500’s total market cap gain year-to-date. Witnessing Nvidia’s ascent is truly witnessing history unfold.

The momentum continues – Nvidia now sits a mere 3% shy of dethroning Microsoft as the world’s most valuable company. With a pre-market jump of another 2% and a staggering 35% gain in the last month, the question lingers: will Nvidia claim the top spot this week?

Strong Demand for Nvidia’s AI Chips

Several factors are driving Nvidia’s stock price:

- Enterprise AI Adoption: Hewlett Packard Enterprise (HPE) reports strong demand for its AI servers powered by Nvidia’s H100 chips, highlighting enterprise adoption of AI across various sectors.

- Generative AI Leadership: Nvidia remains the leader in generative AI, a rapidly growing field with vast potential.

- New Chip Developments: Nvidia plans to unveil its most advanced AI platform in 2026, featuring next-generation memory for faster processing.

- Data Center Expansion: Partnerships with Foxconn for building advanced computing centers in Taiwan using Nvidia’s Blackwell chips signify Nvidia’s push into data centers for autonomous vehicles and electric vehicles (EVs). While Tesla currently uses Nvidia chips, their plans to build custom chips in the future pose a potential challenge.

Nvidia Stock Performance

Net Worth of Nvidia: Nvidia has joined the exclusive $3 trillion club, becoming the third U.S. company to achieve this sky-high market valuation. Apple blazed the trail in 2023, followed by Microsoft earlier in 2024. But Nvidia’s climb has been the most spectacular – reaching the $3 trillion mark in a record-breaking 96 days, surpassing the growth rate of both Apple and Microsoft. This rapid ascent underscores the intense investor confidence in Nvidia’s future potential.

- Record Highs: Nvidia shares surpassed the $1,100 mark after Tesla CEO Elon Musk revealed Nvidia as a supplier for his AI startup, xAI.

- Approaching $3 Trillion Market Cap: Nvidia’s market capitalization is nearing the coveted $3 trillion milestone, joining the ranks of tech giants like Microsoft.

- Stock Split: A 10-for-1 stock split effective Friday will make Nvidia more accessible to a wider range of investors and potentially position it for inclusion in the Dow 30 index.

Past Performance and Analyst Ratings Of Nvidia Stock

- Stellar Earnings: Nvidia’s fiscal first-quarter results shattered expectations, with sales surging 262% and earnings per share skyrocketing 461%.

- Analyst Optimism: Leading analysts like Baird, Susquehanna, and Barclays have increased their price targets for Nvidia stock on the back of its impressive performance.

Nvidia’s Competitive Edge

- AI Trailblazer: Nvidia pioneered graphics processing units (GPUs) that revolutionized computer gaming. Now, their chips power applications in healthcare, automobiles, robotics, and more.

- Dominant AI Chip Market Share: Nvidia dominates the data center AI chip market, even with competition from Google’s Tensor Processing Units (TPUs).

- Future Growth Potential: The global AI chip market is expected to experience significant growth, reaching an estimated $119 billion by 2027, according to Gartner. Nvidia is well-positioned to capitalize on this growth.

Is Nvidia Stock a Buy Now?

While Nvidia is a strong company with immense potential, its stock price is currently in a profit-taking zone after exceeding its buy points. Investors considering Nvidia should wait for a potential pullback, or a new follow-on buy point before initiating a position.

What does NVIDIA do?

NVIDIA is a leading designer of graphics processing units (GPUs), which are specialized processors that handle graphics rendering and other intensive computational tasks. They’re crucial for applications like video editing, gaming, and artificial intelligence (AI). Beyond GPUs, NVIDIA also develops application programming interfaces (APIs) for data science and high-performance computing, and system on a chip units (SoCs) used in mobile computing and the automotive industry. They’re a major player in the field of AI hardware and software.

Who is NVIDIA owned by?

Nvidia isn’t owned by a single entity, but rather a diverse group of investors. Over half (around 52%) of the Nvidia stock is held by institutional investors, which are big players like investment firms and hedge funds. Insiders, like company executives and founders, own a smaller chunk at about 4%. The remaining 44% Nvidia stock is owned by individual investors like you and me, or by public companies that have invested in Nvidia Stock. This mix of ownership keeps things interesting in the world of Nvidia’s stock!

Who is the largest investor in NVIDIA?

While company executives like Ajay Puri, who holds over half a million shares currently worth around $500 million, have a stake in Nvidia, the biggest individual investor outside the leadership team appears to be billionaire venture capitalist Mark Stevens.

NVIDIA STOCK Conclusion

Nvidia is a leader in the high-growth AI chip market, boasting a strong track record and exciting future prospects. However, careful research and consideration of current Nvidia stock price positioning are crucial before making any investment decisions.

Pingback: Europe Takes a Calculated Step: The European Central Bank Cuts Rates for the First Time in Five Years - American Report