Stock Market: On Friday, US stocks experienced significant downturns despite initial optimism following an encouraging inflation report. Here’s a detailed look at the market’s behavior and key events influencing it:

Key Indices Performance

- Dow Jones Industrial Average (DJI): The blue-chip index managed to rise by 0.2%, recovering slightly after a series of sharp losses over the past two days.

- S&P 500 (GSPC): This broader index fell by 0.7%, indicating a challenging week for many stocks.

- Nasdaq Composite (IXIC): The tech-heavy index saw the most substantial decline, dropping by 1.6%, as investors retreated from major tech stocks.

Inflation Data and Stock Market Response

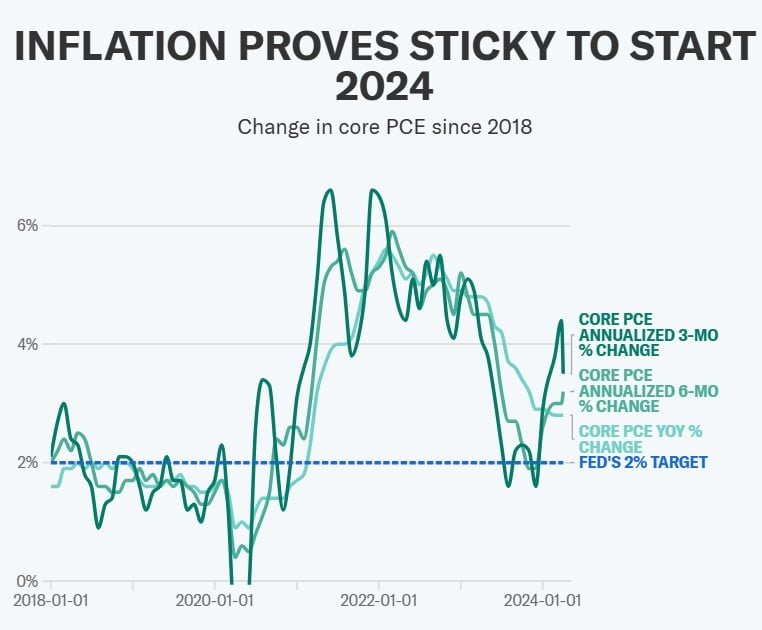

The market initially responded positively to the Personal Consumption Expenditures (PCE) price index report, which showed a slight slowdown in inflation. The “core” PCE index, excluding food and energy costs, rose by 0.2% in April, down from a 0.3% increase in March. Despite this slowdown, the data suggested that inflationary pressures remain persistent.

Bond Market Reaction

Following the inflation report, bond yields declined. The benchmark 10-year Treasury yield fell below the 4.5% mark, indicating some relief in the bond market.

Corporate Highlights and Stock Movements

- Trump Media & Technology Group (DJT): Shares fell sharply after former President Donald Trump was convicted on 34 counts of falsifying business records. This significant legal outcome had an immediate negative impact on the stock.

- Dell Technologies (DELL): Despite reporting a rise in revenue, Dell’s shares plummeted by 22% due to disappointing sales in its AI server segment, falling short of high investor expectations.

- Gap Inc. (GPS): In contrast, Gap saw its stock surge by 27% following a strong earnings report, highlighting growth across all its brands.

Dell Misses Expectations, Gap Soars

Dell Technologies (DELL) reported a rise in revenue but disappointed investors with its outlook. The company’s AI server sales fell short of expectations, leading to a 22% plunge in its stock price. Conversely, Gap Inc. (GPS) defied expectations with strong first-quarter earnings and impressive sales growth across all four of its brands. This positive performance resulted in a 27% surge in Gap’s stock price.

Afternoon Trading Trend

In the afternoon, stocks continued to decline as investors pulled back from the big tech names that have driven recent gains. This retreat was more pronounced in the tech sector, affecting the Nasdaq Composite heavily.

Notable Individual Movers

- MongoDB (MDB): Shares dropped by 25% after the company issued weak guidance and reduced its forecast for the fiscal year, disappointing investors.

- Trump Media & Technology Group (DJT): After the initial drop, shares showed some resilience, bouncing back by about 6% later in the day.

Trump Media & Technology Group (DJT): A Rollercoaster Ride

Shares of Trump Media & Technology Group (DJT), the parent company of former President Donald Trump’s social media platform Truth Social, experienced a wild ride throughout the day. The stock initially plunged 5% in pre-market trading after Trump was convicted on all 34 counts of falsifying business records. However, it staged a comeback in early trading, surging 6%. This volatility reflects the ongoing legal and political controversies surrounding Trump, which can significantly impact investor sentiment.

Market Sentiment and Rate Cut Predictions

Market sentiment was somewhat buoyed by the potential for a Federal Reserve rate cut. The probability of a rate cut in September rose to nearly 55%, up from 51% the previous day, as investors reacted to the latest inflation reading.

Bill Ackman’s Pershing Square IPO Consideration

Hedge fund manager Bill Ackman is considering an IPO for his firm, Pershing Square, potentially as early as next year. This move, reported by the Wall Street Journal, comes as Ackman leverages his growing social media presence. The IPO would follow a stake sale to investors, expected to value the firm at around $10.5 billion.

Ackman’s Political and Social Stances

Ackman has been vocal on various political and social issues, including support for Donald Trump and opposition to diversity, equity, and inclusion efforts. His involvement in these areas has added a layer of complexity to his public persona.

Conclusion

The stock market’s performance on Friday reflects a mix of relief over easing inflation and concerns about ongoing economic challenges. Key corporate developments, legal outcomes, and investor sentiment around potential Fed actions continue to drive Stock market volatility.

Key Takeaways

- The US stock market experienced a volatile week, with initial optimism on inflation data giving way to afternoon selling.

- The PCE price index showed signs of easing, raising hopes for potential future rate cuts from the Fed.

- Trump Media & Technology Group’s stock price fluctuated wildly in response to Trump’s legal troubles.

- Dell’s disappointing outlook overshadowed its revenue growth, while Gap’s strong earnings report fueled a stock price surge.

- Bill Ackman is considering taking his hedge fund Pershing Square public.

- Market bets on potential rate cuts are increasing in response to the latest inflation data.

Important information about Stock market Inflation

What Happens to Stocks If Inflation Decreases?

Answer: When inflation decreases, stocks often benefit. Lower inflation usually means lower interest rates, which can boost economic activity and corporate profits. This typically leads to higher stock prices. The relationship between inflation and stock prices is often inverse; as inflation falls, stock prices tend to rise.

Why Does the Stock Market Go Down When Inflation Rises?

Answer: When inflation rises, central banks usually increase interest rates to control it. Higher interest rates make borrowing more expensive, reducing market liquidity and consumer spending. This environment often leads to a bearish market, as investors sell off stocks to avoid potential losses due to reduced corporate earnings.

How Does the Consumer Price Index (CPI) Affect the Stock Market?

Answer: The CPI can influence the stock market indirectly. While CPI data itself may not always cause immediate market moves, higher inflation indicated by CPI often leads to higher interest rates. This can slow down business activity and reduce consumer spending, negatively impacting stock prices. Conversely, a lower CPI supports continued consumer spending and business investment, favoring stock market growth.

Do Stocks and Shares Beat Inflation?

Answer: Historically, stocks and shares have been effective at outpacing inflation over the long term. Investing in equities has typically allowed savings to grow faster than inflation, providing a reliable way to maintain purchasing power. However, in the short term, Stock market performance can be less predictable, depending on various economic factors.

What Is the Return of the Stock Market After Inflation?

Answer: Over the long term, the average annual return of the S&P 500, after accounting for inflation, has been approximately 7%. This consistent long-term performance underscores the resilience of the stock market as an investment vehicle, despite short-term volatility.

What Are the Worst Investments During Inflation?

Answer: During high inflation, certain investments tend to underperform:

- Cash: Loses purchasing power over time.

- Fixed-rate bonds: Provide returns that may not keep up with inflation.

- Companies with weak pricing power: Struggle to pass on higher costs to consumers. Investors might consider avoiding these assets and instead look towards investments that perform well in inflationary environments, such as real estate, commodities, and stocks with strong pricing power.

What Happens to Stocks When Interest Rates Go Up?

Answer: Rising interest rates generally lead to reduced spending by both consumers and businesses, as borrowing costs increase. This decrease in spending can lead to lower corporate earnings and, consequently, falling stock prices. Conversely, when interest rates drop, spending and investment typically rise, boosting stock prices.

What Is the Relationship Between Inflation and Investment?

Answer: (Stock Market) Rising inflation negatively impacts the returns of equities and bonds while devaluing cash. To mitigate these effects, investing in high-quality companies that provide essential goods and services, along with safer government bonds, can be a sound strategy. Such investments are often more resilient in inflationary periods.

Pingback: Heartbreak for Ronaldo: Al Nassr Falls in King's Cup Final, June 1 - American Report